Investing Wisdom from the Playbook of Nick Saban

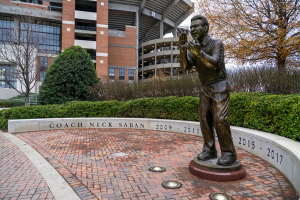

With the retirement of revered University of Alabama football coach Nick Saban set against a backdrop of other significant personnel changes, such as the retirement of Bill Belichick and departure of Pete Carroll from the Seattle Seahawks, the beginning of 2024 has marked substantial shake-ups in the world of football. This slew of transitions signals not only the end of an era, but the start of a new chapter for the sport.

Seasons of change provide great opportunities for reflection and personal growth. In my 12 years of living in Alabama, I’ve had the chance to study Coach Saban and his many successes. His profound impact is evident not only in football, but his principles are often applied in business strategy and leadership. It’s intriguing to draw parallels between Saban’s approach to the game and the intricacies of the investment world. Here are investment lessons inspired by Coach Saban’s prolific career, offering insights derived from his methods for success that transcend the boundaries of sport.

Follow “The Process”

Saban’s well-honed philosophy, “The Process,” emphasizes focusing on what one can control in the present moment, and not on a distant, lofty goal, such as a National Championship. For investors, the message is this: don’t obsess over short-term market movements or get distracted by “hot tips.” Instead, follow an investment process that relies on empirical data and research, guided by discipline.

Pay Attention to Detail: Everything Matters

Saban spent decades developing his unparalleled eye for detail, studying player metrics, opponent strategies, and game film. In investing, well-informed decision making becomes elevated through meticulous data examination, leaving no stone unturned to make informed decisions. Small details such as taxes, turnover, and transaction costs can have a significant impact on investment outcomes.

Build a Diversified Team

Saban’s success was due in part to his ability to recruit a well-rounded and diverse team of players. In investing, this equates to being broadly diversified across assets, market cap, style, and geography for better risk-adjusted returns. Research shows that a diversified portfolio, rather than individual stock picking, tends to outperform the market over the long term.

Surround Yourself with the Right People

Coach Saban never failed to credit his carefully curated staff for his team’s success. He understood you are the sum of those with whom you choose to surround yourself. Similarly, successful investors surround themselves with a sort of personal board of directors who will hold them accountable and offer practical and objective advice. This personal board can include professionals (accountants, financial advisors, or attorneys) or informal relationships, such as family and friends.

Have a Plan and Execute It

Saban was a master strategist. His clear, well thought-out game plans were key to his success. Investors should similarly have a solid plan and understanding of their personal risk tolerance, goals, and objectives to help create a roadmap for investment success.

A Winning Combination

Nick Saban’s principles of being process-focused, detail-oriented, diversified, well supported, and meticulously planned can be a winning combination for financial success. At Savant, this wisdom and foresight are integrated into our evidenced-based investing approach. If you’d like to learn more about how our investment approach helps clients pursue their ideal futures please consider talking with one of our financial advisors.

Congratulations on your retirement, Coach Saban. Roll Tide!