2023 Investment Showdown: Money Markets vs. Stocks and Bonds

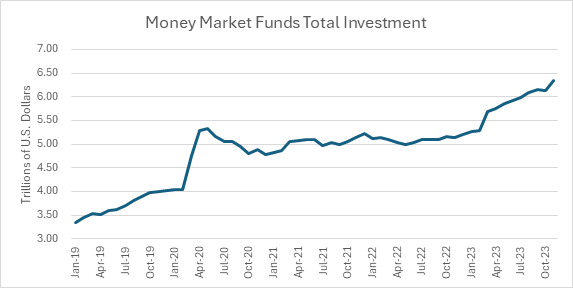

One might say that 2023 was the year of the money market fund. As the Fed raised rates, eventually stopping in July at 5.00-5.25%, investors poured cash into money market funds to latch onto a healthy return. By the end of November, these money market funds saw an additional $1.1 trillion.

Source: SEC Form N-MFP2, Office of Financial Research

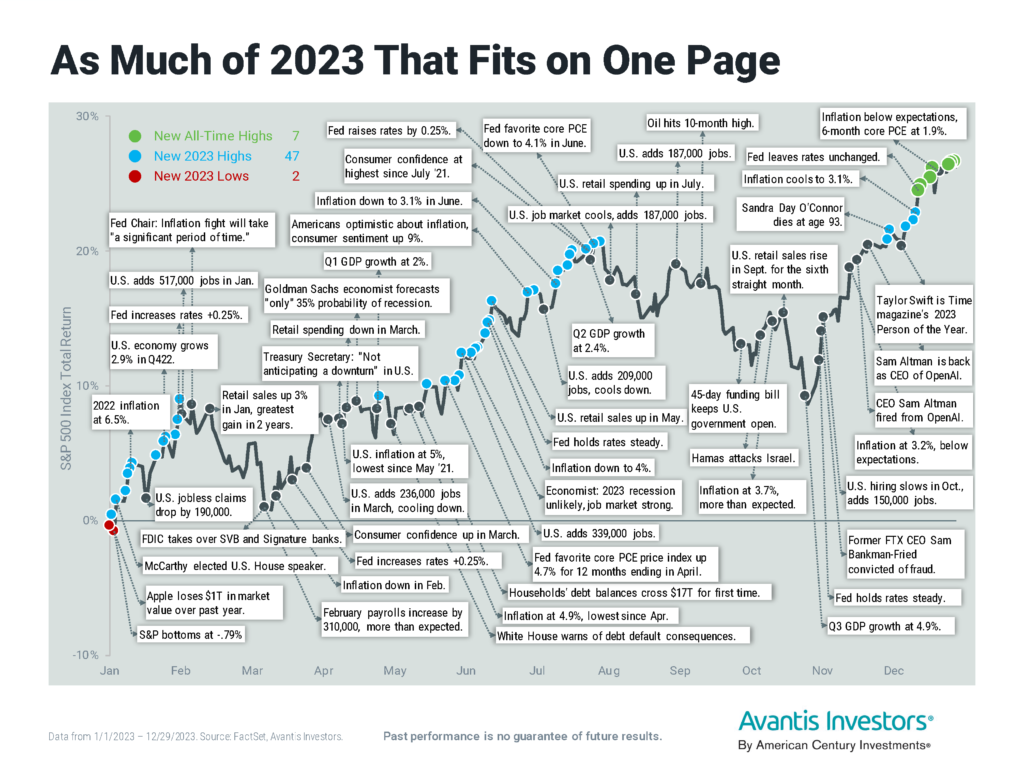

Uncertainty also caused problems for investors in 2023. Throughout the year, investors grappled with:

- Economic uncertainty and recession fears

- Collapse of several banks

- Inflation

- Rising interest rates

- Tech industry layoffs

- Threats of Government shutdown

- Geopolitical turmoil

- Bond interest rate volatility

With all these worries, a safe 5% return on cash in a money market fund or CD looked to many like a pretty good deal. Meanwhile, economic conditions proved to be better than expected in 2023 and the stock markets reached multiple new highs throughout the year.

Looking at your return on cash versus stock and bonds: If you had invested on any given day of the 250 possible days you could have invested in the stock market in 2023, your return on global stocks would have been higher than a money market fund by year end on 248 of those days, or 99% of the time.1 Turning to bonds, you would have outperformed a money market fund by investing in bonds on 167 days out of the 248 days the bond market was open, or 67% of the time.1 Obviously, hindsight is 20/20, and investing in the stock or bond market on any one of those days wasn’t necessarily easy to do. The hardest day to invest is always today.

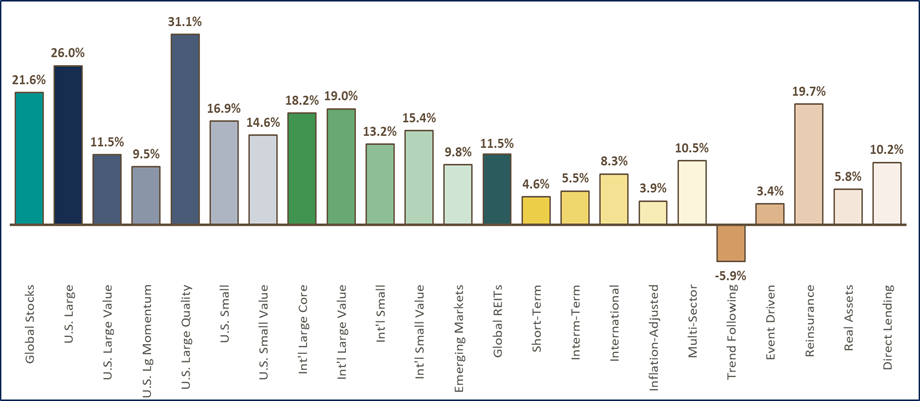

To end the year: U.S. large cap stocks were 26% higher in 2023 and small company stocks were 16.9% higher. Developed international stocks soared 18.2% for the year and emerging market stocks climbed 9.8%.2 Bonds also turned positive across all sectors and alternative strategies provided favorable returns as well.

2023 Calendar Year Returns

Source: Morningstar Direct. Data as of December 31, 2023. See Important Disclosures for indices represented.

While rates on money market funds in 2023 were attractive, don’t expect them to last forever. If inflation fears ease and economic growth slows as expected in 2024, the Fed may cut rates several times. Expect money market fund rates to come down as well.

At Savant, we don’t believe in trying to time the market. No one has a crystal ball, and trying to buy at market bottoms and sell at peaks creates unnecessary risk, costs, and taxes. It could also dramatically change your retirement plan if you miss only a few good days. Instead of trying to time the market, we believe a better approach is to follow a disciplined strategy that removes emotional decision making, takes a long-term focus, and demonstrates diversification. If you are unsure about your investment strategy, consider consulting with one of our financial advisors who can help provide guidance tailored to your specific financial situation and goals.

1Source: Morningstar: Data for indices available for the following dates: Schwab Treasury Oblig Money Inv (2023); MSCI ACWI IMI NR USD (2023); Bloomberg US Agg Bond TR USD (2023).

2Source: Morningstar: Data for indices available for the following dates: U.S. large cap stocks, CRSP US Total Market TR USD (2023); Small company stocks, Russell 2000 TR USD (2023); Developed international stocks, MSCI EAFE NR USD (2023); emerging market stocks, MSCI EM NR USD (2023).

Important Disclosures

Indices used – Global stocks: MSCI ACWI IMI; U.S. Large Core: CRSP US Total Market; U.S. Large Value: Russell 1000 Value; U.S. Large Momentum: MSCI USA Momentum Index; U.S. Large Quality: MSCI USA Sector Neutral Quality Index; U.S. Small Core: Russell 2000; U.S. Small Value: Russell 2000 Value; International Large Core: MSCI EAFE; International Large Value: MSCI EAFE Value; International Small Core: MSCI EAFE Small Cap; International Small Value: MSCI EAFE Small Value; Emerging Markets: MSCI EM; Global REITs: S&P Global REIT; Short-Term Bond: Bloomberg US Govt/Credit 1-3 Yr; Intermediate-Term Bond: Bloomberg US Agg Bond; International Bond: Bloomberg Global Aggregate ex US Hdg USD; Inflation-Adjusted Bond: Bloomberg Gbl Infl Linked US TIPS; Multi-Sector Bond: 1/3 Bloomberg US Corporate High Yield, 1/3 Bloomberg US MBS, 1/3 JPM EMBI Global Diversified; Trend Following: Credit Suisse Mgd Futures Liquid; Event Driven: Wilshire Liquid Alt Event-Driven (appended with additional indices prior – available upon request); Reinsurance: SwissRe Global Cat Bond; Real Assets: In the current month – DJ Brookfld Global Infra; earlier – custom blend of DJ Brookfld Global Infra, S&P Global LargeMidCap Commodity and Res, S&P Global Timber & Forestry, DJ Commodity, DJ Brookfld Global Infra Broad Market Corp Bond, S&P Global LargeMidCap Commodity and Res Corp Bond, S&P Global Dev Sovereign Inflation-Linked Bond (appended with additional indices prior to inception – available upon request); Direct Lending: Cliffwater Direct Lending-Senior (most recent quarter uses Morningstar Lev Loan BB due to data lag).