Articles, Market Commentary

& More

Past Commentary & Articles

The Tax Cuts & Jobs Act lowered tax rates for many individuals and married couples. If allowed to sunset on Dec. 31, 2025, tax rates could revert to their 2017 levels.

Did you make any resolutions for 2024? Now that January is over, how are you feeling about achieving them?

It’s almost time to start collecting 2023 tax documents in preparation for the April 15th filing deadline. One topic sure to come up is the question of which income is taxable—a matter that surprises many households.

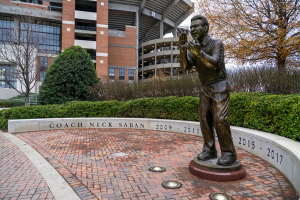

The beginning of 2024 has marked substantial shake-ups in the world of football. This slew of transitions signals not only the end of an era, but the start of a new chapter for the sport.

Over the past year, we saw markets rebound from a dismal 2022, but many investors still felt like they were falling behind as stock market performance was led by a concentrated group of large companies known as the Magnificent Seven. The temptation to chase the top performers is only natural, but history has shown us time and again that this is not a good idea.

We believe the quality of advice you receive can help make a big difference in your financial success. Whether you’re looking to invest, save for retirement, or simply create a budget, getting the right advice can help you make informed decisions.

Having meticulously planned and saved throughout your life, you’ve reached the moment of retirement! The excitement is palpable, but there might be lingering concerns about ensuring your assets cover all your needs.

If a year-end bonus from your employer is sitting in your bank account, congratulations! Here are several ideas on how to deploy your year-end bonus that could help you improve your financial future.

As the Federal Reserve raised rates in 2023, money market funds became popular, drawing in $1.1 trillion due to economic uncertainty, bank collapses, inflation, and other factors. Yet, investing in global stocks and bonds likely would have yielded higher returns than money market funds.

Plan sponsors are facing new considerations with the inclusion of long-term part-time (LTPT) employees in 401(k) plans. Here are some highlights of the essential aspects plan sponsors should address to ensure compliance and effective administration.

As hardship distributions and participant loans increase, plan sponsors need to understand their responsibilities to oversee and track these activities. Even if they use a third-party administrator, plan sponsors are ultimately responsible for meeting the IRS’s guidelines for reporting these activities.

As their retirement approaches, most people tend to focus heavily on the financial element of their planning. But the financial capacity to retire is merely one area of several critical elements involved in effective retirement planning.