Tag: Investment Planning

A Value-able Roadmap

Investors are always looking for a roadmap that will reveal the path to market-beating returns. For long-term investors, we can look to one of the market’s worst kept secrets: value investing.

Value on the Horizon

Investment research analyst Danny Noonan looks back at the recent strong performance of value stocks and discusses possible scenarios for 2021.

Does it Make Sense to Buy Company Stock as Part of your 401(k) Plan?

Buying company stock as part of your 401(k) plan may be beneficial from a tax perspective.

Own the Haystack!

Identifying the big winners of the stock market ahead of time is unlikely. And as such, it would be wise to focus on owning the haystack rather than searching for the needle.

The Factor Zoo

Professionals have developed theories about factors since 1964. Explore the return premium to our factors: some are big, some are small and some don’t exist at all.

Our Afternoon Chat with Apollo Lupescu

Savant recently hosted a “Navigating Turbulent Financial Markets” webinar with Apollo D. Lupescu, Ph.D., Vice President of Dimensional Fund Advisors. Given the favorable feedback from the event, we are pleased to summarize a few of the takeaways.

2020 First Half Review: Tale of Two Quarters

If the first half of 2020 is any indication of the second, the wild ride of 2020 could be far from over. This year has been a reminder of just how important it is to stay the course and focus on long‐term investment objectives, not short‐term news headlines.

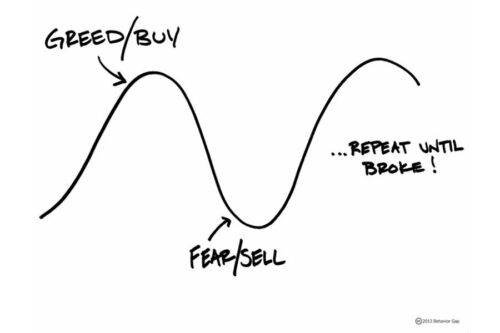

Our Old Friend Volatility is Back

Just as many people were starting to think markets only move in one direction, the pendulum has swung the other way. Financial advisor Edward Cruickshank offers seven simple truths to help you live with volatility.

Sell in May – Go Away!

Market timing blares its horn each spring as the common adage rings, “Sell in May and Go Away!” This calls for selling your portfolio in May only to reinvest the coming October, therefore reaping potential higher risk adjusted returns. Though certain factoids support the sentiment, is it truly in your best interest? Economists continue to […]

Market Update – May 2020

May saw positive returns in the market across the majority of asset classes. U.S. small (+6.5%) led the charge domestically while international small came in strong (+7.0%) as well. Global stocks dipped slightly but still came in positive at +4.6%. Bonds hovered close to zero, with intermediate‐term bonds holding the strongest return (+0.8%). With respect […]

Why Is the Market Going up When the Economy Is Going Down?

Financial advisor Cal Brown explains why the stock market and the economy don’t always move in lockstep.

Our Guide to the Coronavirus Crisis: 6-2-2020 Coronavirus Chart Pack

Our Investment Research Team’s latest update to the Coronavirus Crisis Chart Pack: Risk assets continue to surge as continuing unemployment claims data verify that some citizens are beginning to return to work in the U.S. Download our 6-2-2020 Coronavirus Crisis Chart Pack